From logistics to driver services, India’s economic rise is unstoppable, but businesses are still stuck when it comes to hiring right.

At Drimo, we’ve observed how this challenge impacts businesses across sectors. Many businesses are forced to choose between hiring through a formal staffing agency paying high costs due to the 18% GST on staffing services or hiring informally to save money.

This high GST burden discourages companies from choosing structured, compliant staffing solutions. Instead, they often resort to informal hiring, which undermines worker security, safety standards, and even government revenues.

We believe reducing the GST on staffing services could significantly improve the hiring ecosystem making it easier and more attractive for businesses to hire verified, trained professionals, while creating secure, dignified jobs and improving safety for everyone.

How High GST Fuels Informal Hiring

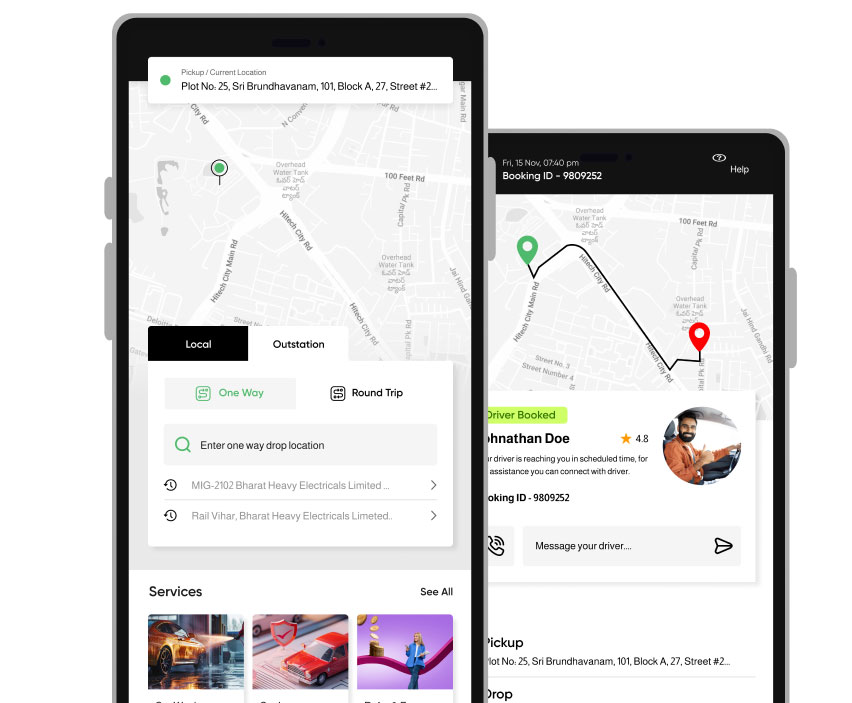

Staffing companies like Drimo play an essential role in connecting businesses, households, and organizations with structured, verified, and compliant manpower, such as professionally trained and background-checked drivers. When businesses hire through formal staffing agencies, workers are employed responsibly, with proper contracts, legal documentation, social security benefits, and training. At the same time, businesses stay compliant with labour laws, tax regulations, and safety standards.

However, the high 18% GST on staffing services makes this formal route expensive for many businesses. To save costs, they often turn to informal hiring directly engaging workers without going through registered agencies.

This informal approach may seem cheaper upfront but comes with serious downsides:

- Businesses bypass taxes and legal obligations, exposing themselves to compliance risks.

- Workers are left without job security, health or retirement benefits, and fair wages.

- There is no systematic verification or training of workers, which compromises accountability and workplace safety.

- The government also loses revenue as these transactions happen outside the formal economy.

Reducing the GST on staffing services could encourage more businesses to choose formal hiring channels like Drimo ensuring safer workplaces, secure livelihoods for workers, and greater compliance for everyone involved.

Structured vs Gig Employment Generation

The gig economy has given many people a way to earn, but often at the cost of job security and dignity. In contrast, staffing companies like Drimo provide verified and background-checked staff, offer benefits like PF and insurance, and ensure proper training and compliance.

If the GST rate on staffing services were reduced from 18% to 5%, more companies would be encouraged to hire through formal agencies. This would create more secure jobs and help restore dignity to millions of workers, particularly in the driver services sector, where over five crore drivers are still informally employed, with no benefits, no training, and no security.

These drivers, who keep families, businesses, and logistics moving, deserve the respect and protection that come with formal employment.

Road Safety: The Hidden Benefit

Drivers play a crucial role in road safety, whether they manage corporate fleets, taxis, delivery vehicles, or personal cars. When drivers are hired informally, proper training and behavioral checks are often skipped, police verification is ignored, and in the event of an accident, the full liability falls on the vehicle owner.

On the other hand, hiring drivers through formal, professional staffing channels ensures that they are trained, insured, and regularly monitored. Police verification becomes mandatory, and reliable support is available in case of emergencies.

Reducing GST on staffing services would lower costs for businesses and individuals, making it easier to opt for structured hiring. This would directly enhance road safety, reduce accidents, and ensure greater accountability benefiting everyone who uses the roads.

Why Formal Staffing Strengthens the Economy

Encouraging formal staffing creates a ripple effect throughout the economy. Formal employment leads to higher tax and GST compliance, improves workers incomes and security, and delivers better-trained, more productive manpower.

It also makes services safer and more reliable, which improves customer trust and satisfaction.

Why This Matters to You

Whether you’re a business owner, HR professional, or a family hiring a driver, this policy change directly benefits you:

- Lower costs for verified, professional staff.

- Safer and more reliable services thanks to proper training and checks.

- Peace of mind knowing your workers are secure and compliant.

- Makes formal staffing more affordable for businesses.

- Improves compliance and boosts government revenue.

- Creates lakhs of secure jobs with dignity.

- Raises safety and quality standards in key sectors like transportation.

This isn’t just about tax policy, it’s about building a stronger, safer India where dignity of labour meets accountability and growth.

A Policy Change for a Safer, Stronger India

A GST reduction on staffing services is more than a tax cut, it’s an opportunity to empower millions of Indians with secure jobs, improve road safety, and help businesses stay compliant and competitive. At Drimo, we manage driver staffing for more than 80 companies. We’ve seen how structured employment transforms lives for workers, for businesses, and for families. We remain committed to advocating policies that promote formal, safe, and dignified employment, starting with a fair GST rate for staffing services. It’s time to reward organizations that invest in training, compliance, and human dignity and take a step toward a safer, more prosperous India.

Ready to hire verified, trained, and reliable drivers?

Contact Drimo today and experience professional driver services you can trust.

No. GST applies only when you hire through a staffing agency, because professional driver services are treated as a taxable service under the current GST rate staffing services norms.

Generally, no. Most private staffing, including driver services, falls under the 18% GST rate staffing services. Some government or social-welfare contracts may have exceptions, but regular private hires do not.

No. A GST reduction staffing services would lower the cost for clients, making professional hiring more affordable — but drivers would still earn fair wages and benefits as per law.

If you don’t use a staffing agency, you’ll need to handle police verification, document checks, and contracts yourself. To avoid this hassle, you can rely on Drimo for verified, trained, and insured driver services that meet compliance standards.